A guide on what NOT to do in real estate investing…

I love being a real estate agent; I miss being an investor. If you like real estate investing, then you can learn from my mistakes. This is all about learning what not to do, and why.

One of the favorite aspects of being a real estate agent is helping people achieve their dreams, but it’s not always easy. Sometimes I miss the simpler life of real estate investing, when I was in the game for no one else but myself.

This week alone, I had four or five fiascos that sent my head spinning, and as a private investor, they were situations I could handle. Now that I represent clients, I explain to them the things I know to be true about how they can profit by making small easy decisions, and I watch them make the wrong choices again and again. All I can do is watch.

This week, I tried to turn one situation around, but I became a victim of my own ambition. This is the tale of what I tried to do and how it failed so that you can learn from my mistakes.

A wise person learns from other people’s mistakes, and if you are interested in investing, you should take a moment to learn from mine. Read this article to the end, and you will find out a big mistake that I made which I will never make again!

Learn from Other People’s Mistakes

When the poop hits the fan, I am always glad for the years of investing experience that I have had prior to being a Real Estate Agent. It is because of this experience, that I knew I could turn things around when one of my home sellers decided that they would rather let their listing agreement expire so they could accept an offer at $180,000 than continue to find a full price offer at $240,000. They made this decision after receiving two full price offers.

Thankfully, I have the real estate experience to back things up when I need to get creative. I listen to amazing audio books to keep my skills fresh. One that I recently listened to, which I enjoyed immensely was “Real Estate Investing Gone Bad: 21 True Stories of What Not to Do When Investing in Real Estate and Flipping Houses.”

(Want to listen to this great book for free? Get 2 free books when you start a new audible subscription using this link.)

I listen to books like this while I am driving all over the city, and I hear stories from other investors about things they didn’t consider and what they could have done to make things better for themselves and everyone else. The stories are dramatic and show how bad things can get when you don’t know what you are doing.

Wise investors learn from other people’s mistakes, which makes books like “Real Estate Investing Gone Bad” invaluable! But, no matter how much preparation that you have, you cannot prepare for everything.

Putting on my real estate investing cap

When my sellers told me that they were going to take an offer at $180,000, my head started spinning! How could they even think about that when we had two offers at $240,000 already? What they truly wanted was to avoid the stress of watching over a vacant house. After all, vandals and burglars haunt the night, and vacant houses are their candy.

I tried twice to offer them a listing agreement on behalf of the brokerage, and they rejected me twice. Once they rejected my most reasonable offer, I decided that I would turn the situation around like an investor would.

How a real estate investor structures this deal

I made them an offer, like I had made dozens of times before with other home owners.

First, I offered them more than the cash buyer. Because I knew the house could sell for $240,000 without repairs, I was not worried about offering $190,000. So I did.

Second, since I did not have $190,000, I convinced them to allow me to have a flexible close date, which would allow me to find a buyer for my new house. (Remember, as a buyer I am no longer selling their house, I’m selling my house, so I no longer need a real estate license).

Third, since no escrow company I called would allow a double close, I convinced the sellers to allow me to use Seller financing for a period of up to 7 days. With Seller financing, I could close the first escrow and take title. I then would owe the Seller’s $190,000. Immediately after, I could then close the second escrow and transfer title to the new buyers. The second escrow would pay the $190,000 note from the proceeds. Essentially like a double close, but a little fancy footwork to make it more pallet-able for the escrow company.

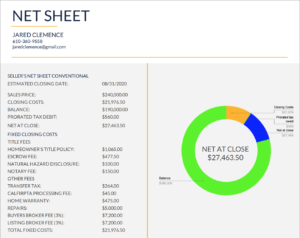

The deal has its risks, but if I can find the buyer and keep the repair costs below $5,000, then I could walk away with $27,463.50 in investor profits PLUS the $7,200 in Listing Broker fees (see left column of the net sheet) and possibly an additional $7,200 in Buyer broker fees if I could find a buyer.

Where things went wrong

I’m big on honesty. You get nowhere in life if you are not honest. Karma always comes back to get you.

Once I had the signed contract in hand between myself and the sellers, I sat down with my broker. I had to explain why they would soon see a listing agreement under which I, Jared Clemence, was selling a house to which the public record said I had no title.

I explained all about how “equitable title” works and how I will have title at the time escrow closes on the listing, so “it’s all good.”

But then….

Then my broker explained to me that in California, licensed Real Estate Salespersons give up the right to enter real estate contracts in their own name!

It couldn’t be true! It’s impossible that I have less rights than I did before I received a license. I had to research it. I had to put on my Law Student cap and get to the bottom of it!

What I didn’t know: The law in California

I searched Lexis Nexis for several hours and finally discovered Merrifield v. Edmonds (1983) 146 Cal.App.3d 336. I rue the day that I found this case.

The court of Merrifield wrote:

“A real estate salesperson cannot contract in his or her own name or accept compensation except from the broker under whom he or she is licensed.” Merrifield v. Edmonds (1983) 146 Cal.App.3d 336, 342-343, emphasis added.)

Those words kill me! I had to make sure they were well founded, so I checked the cited sources. The court cites two references.

The first is California Business and Professions Code section 10137. This section lists several things that cannot occur, but none of them state that a salesperson loses the right to enter into a contract representing himself, which was an inalienable right in my opinion!

My opinion was wrong. The second citation held the dreadful truth.

Grand v. Griesinger (1958) 160 Cal.App.2d 397

The second case referenced was Grand v. Griesinger (1958) 160 Cal.App.2d 397.

In the 1950’s, Mr. Grand attempted to create several businesses. He contracted with Brokers to give each of the businesses lawful faces, and he would then conduct his business, essentially without supervision.

Mr. Grand was a licensed real estate salesperson, but he never took his brokers exam. Still, he ran a rental service under which he represented landlords in finding tenants. This service ran next to a real estate brokerage under the same name, and Ellen Noy (a licensed broker) operated and managed that portion of the shared business.

The court gave careful analysis to Mr. Grand’s position and essentially asked the question: What is the difference between a broker and a salesperson who works under the broker? And, what did the legislature intend by requiring one to work under the other?

The court determined that the difference was that the broker had extensive experience that far exceeded that of a salesperson, who could begin representing people as soon as he was licensed.

To be a broker, however, one must work several years as a salesperson and complete extensive additional education. On top of that, the broker must take an additional exam that shows that the broker’s knowledge far exceeds that of a simple salesperson.

Given all this, the court determined that the legislature must have intended that the public should be protected from people who do not yet have experience to know all that a broker would know. The court then held that given this, the legislature intended that all real estate contracts by a salesperson must be under the supervision of the broker.

Where I think the Court made a mistake

The court took a broad stroke. In the cases that it reviewed to reach it’s decision, it only considered cases where the real estate salesperson entered contracts representing other people. For example, Mr. Grand did not rent out his own real estate. He rented out the real estate owned by others, and in doing this, he was acting as an agent, which requires a license. This licensed activity must be overseen by a broker.

However, this is drastically different from contracts in which no representation exists. When the salesperson represents himself or herself, there is no danger to the public of faulty representation by a novice agent. Any mistakes the salesperson makes affect his own future and not the future of an innocent citizen.

I intend to research this matter further to find some way to get around this issue, but until I can find a way, the law stands as it is. Which means that until I become a broker (May 2020, cross your fingers), I am unable to enter contracts.

What this means for my deal

What this means for my $30,000 deal is that my contract with the sellers was “void ab inito” for being against the law.

I met with the sellers and discussed alternatives. We decided to list the house again. I think they were impressed with my willingness to be creative, and they decided to give me another chance. Real estate investing is sometimes just as much about investing in people and building your reputation for putting other people first.

In exchange for a waiver of liability, I allowed them to keep the repairs I made on the house during the short contract, and I also offered to continue payments on the new alarm system I installed.

The house will sell very soon, and the seller’s will be overjoyed when they close on a full-price offer. But, in the mean time, I stew over the lost profits that could have been.

What this means for my future in real estate investing

So, you can write contracts as an unlicensed citizen. You can write contracts as a broker, but for the short period of time you spend as a Real Estate Salesperson, you loose your rights.

In retrospect, I wish I had known that. I could have found a friend to do the deal for me. I could also have just simply avoided getting my license, but I have it now. What this means for my future is that I need to get my broker’s license so that I can regain my identity as an individual and return to the investing game with vigour.

If you liked this story, you will love to hear some of the other blunders that occur in investments. Check out the book “Real Estate Investing Gone Bad.”

Would you like to learn more about what NOT to do?

If you enjoyed this story of woe and learned something interesting about real estate investing, then you should absolutely consider listening to the book I finished last week. Although written by someone who appears to be a novice at writing, it is very clear that the person has loads of experience and frequently talks to investors where things go completely wrong.

I find this is an essential read or listen for any investor. Pick up a copy of Real Estate Investing Gone Bad or just add it to your wish list for the next time you are in the market for a good audio book by clicking the link below. The link just takes you to the Amazon page where the book is found. It does not purchase the book or add it to your wish list. You have to do that once you get there.

CLICK BELOW TO SEE THIS BOOK ON AMAZON.COM

Don’t forget! You can get a free copy of this book and one other when you sign up for Audible. Click this link to get your first two books free on Audible.com.

Want to read more from Jared?

Not all of my articles are about real estate investing. Check out this article on how to buy your first home at a young age. I was one month shy of my 21st birthday when I bought my first home. With these instructions, you could buy your home even younger.